The card_name is the premium co-branded rewards card for Marriott hotels. This card has a hefty annual fee, but a closer look reveals it’s not as bad as it looks initially due to perks like flexible dining credits, airport lounge access, and elite status. Here are the highlights:

- 100,000 Marriott Bonvoy(R) bonus points after you use your new Card to make $6,000 in purchases within the first 6 months of Card Membership.

- $300 Brilliant Dining Credit: Each calendar year, get up to $300 (up to $25 per month) in statement credits for eligible purchases made on the Marriott Bonvoy Brilliant(R) American Express(R) Card at restaurants worldwide.

- Automatic Marriott Bonvoy(R) Platinum Elite Status.. With Marriott Bonvoy(R) Platinum Elite Status, you can receive room upgrades, including enhanced views or suites, when the stay is booked with a Qualifying Rate at hotels that participate in Marriott Bonvoy, subject to availability upon check-in.

- Priority Pass(TM) Select airport lounge membership, with an unlimited number of visits to over 1,200 airport lounges in over 130 countries, regardless of which carrier or class you are flying. This allows you to relax before or between flights. You can enjoy snacks, drinks and internet access in a quiet, comfortable location. Enrollment required.

- 6X Marriott Bonvoy(R) points for each dollar of eligible purchases at hotels participating in Marriott Bonvoy.

- 3X points at restaurants worldwide and on flights booked directly with airlines.

- 2X points on all other eligible purchases.

- Up to 21X Marriott Bonvoy(R) points for every $1 spent on eligible purchases at hotels participating in Marriott Bonvoy. Earn 6X points with the Marriott Bonvoy Brilliant(R) American Express(R) Card. Earn up to 10X points from Marriott Bonvoy for being a Marriott Bonvoy member. Earn up to 5X points from Marriott Bonvoy with the 50% Bonus Points on Stays, a benefit available with your complimentary Platinum Elite status.

- $100 Marriott Bonvoy(R) Property Credit: Receive up to a $100 property credit for qualifying charges at The Ritz-Carlton(R) or St. Regis(R) when you book direct using a special rate for a two-night minimum stay using your Card.

- Fee Credit for Global Entry or TSA PreCheck®. Receive either a statement credit every 4 years after you apply for Global Entry ($120) or a statement credit every 4.5 years after you apply for a five-year membership for TSA PreCheck® (up to $85 through a TSA PreCheck official enrollment provider) and pay the application fee with your Marriott Bonvoy Brilliant® American Express® Card. If approved for Global Entry, at no additional charge, you will receive access to TSA PreCheck.

- 1 Free Night Award every year after your Card renewal month. Award can be used for one night (redemption level at or under 85,000 Marriott Bonvoy(R) points) at hotels participating in Marriott Bonvoy(R), such as Le Metropolitan, a Tribute Portfolio Hotel in Paris. Certain hotels have resort fees.

- Each calendar year after spending $60,000 on eligible purchases on your Marriott Bonvoy Brilliant(R) American Express(R) Card, you will be eligible to select a Brilliant Earned Choice Award benefit. You can only earn one Brilliant Earned Choice Award per calendar year. See https://www.choice-benefit.marriott.com/brilliant for Award options.

- With Cell Phone Protection*, you can be reimbursed, the lesser of, your repair or replacement costs following damage, such as a cracked screen, or theft for a maximum of $800 per claim when your cell phone line is listed on a wireless bill and the prior month’s wireless bill was paid by an Eligible Card Account. A $50 deductible will apply to each approved claim with a limit of 2 approved claims per 12-month period. Additional terms and conditions apply. *Coverage is provided by New Hampshire Insurance Company, an AIG Company.

- 25 Elite Night Credits each calendar year.

- No Foreign Transaction Fees.

- $650 Annual Fee.

- See Rates and Fees

Keep in mind the following:

You may not be eligible to receive a welcome offer if you have or have had this Card or the Starwood Preferred Guest® American Express Luxury Card or previous versions of these Cards. You also may not be eligible to receive a welcome offer based on various factors, such as your history with credit card balance transfers, your history as an American Express Card Member, the number of credit cards that you have opened and closed and other factors. If you are not eligible for a welcome offer, we will notify you prior to processing your application so you have the option to withdraw your application.

Welcome offer not available to applicants who (i) have or have had The Ritz-Carlton® Credit Card from JPMorgan or the J.P. Morgan Ritz-Carlton Rewards® Credit Card in the last 30 days, (ii) have acquired the Marriott Bonvoy Bountiful™ Credit Card from Chase, the Marriott Bonvoy Boundless® Credit Card from Chase, or the Marriott Bonvoy Bold® Credit Card from Chase in the last 90 days, or (iii) received a new Card Member bonus or upgrade offer for the Marriott Bonvoy Bountiful™ Credit Card from Chase, the Marriott Bonvoy Boundless® Credit Card from Chase, or the Marriott Bonvoy Bold® Credit Card from Chase in the last 24 months.

This is why you should be looking to get the best possible bonus (like a limited-time offer) if you do apply.

$300 Dining Statement Credit. As long as you make $25 in restaurant purchases on this card each month, they $300 in annual dining statement credits should be easily obtainable. This knocks down the scary $650 annual fee down to effectively $350 net. My first read of this perk was that you had to spend it at a Marriott hotel restaurant, but in fact you can make the purchase at any restaurant worldwide.

You can receive up to $300 in statement credits issued to your Card Account for eligible purchases charged to your Marriott Bonvoy Brilliant® American Express® Card at restaurants worldwide. Purchases by both the Basic Card Member and Additional Card Members on an eligible Card Account are eligible for statement credits. Each Card Account is eligible for up to $25 in statement credits per month, for a total of up to $300 per calendar year in statement credits across all Cards on the Account.

Priority Pass Select. Includes access at over 1,200 airport lounges for the cardholder plus two guests free. Enrollment required. I’m not sure how I’d value this perk, but I’ve definitely enjoyed it in the past.

Marriott Bonvoy Brilliant™ American Express® Card Members must enroll in the Priority Pass Select program through the benefits section of their americanexpress.com account or by calling the number on the back of their Card to receive the benefit. Priority Pass is an independent airport lounge access program. At any visit to a Priority Pass Select lounge that admits guests, you may bring in two guests for no charge.

What is a reasonable estimate for the value of a Marriott Bonvoy point? As of April 2022, Marriott no longer has a fixed hotel category chart for booking points. You can still use these points at either long-time Marriott brands (Ritz-Carlton, Renaissance Hotels, Courtyard, Residence Inn, Springhill Suites, Fairfield Inn & Suites) or former Starwood brands (Westin, Sheraton, The Luxury Collection, Four Points by Sheraton, W Hotels, St. Regis, Le Méridien, Aloft), but now it is “dynamic” awards where the points required are more linked to the actual cash cost than before.

Based on multiple real-world searches of redeemable properties, I choose to use a conservative estimate of 0.70 cents per Bonvoy point. That means 95,000 Bonvoy points = estimated $665 redeemable value, and 150,000 Bonvoy points = estimated $1,050 redeemable hotel night value. Remember to compare the full price of the hotel price with all taxes, as that is what you would have to pay instead of just points. With the flexibility of points, you could book a week stay at a modest hotel or a couple nights at a luxury resort.

You can use the Marriott free night search tool to price out some sample hotels for yourself.

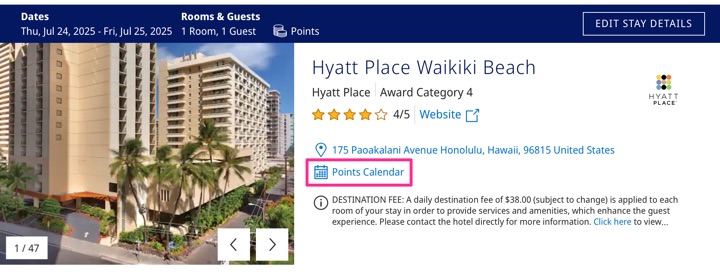

Free Night Award (85K) with Card Renewal. At your card anniversary (when you pay the annual fee), you will receive a Free Night Award that is good for one night (redemption level at or under 85,000 Marriott Bonvoy points) at a participating hotel. This is a much better perk than the other 35K and 50K free night awards out there. It’s definitely not hard to get $350 of value out of this award. Here are some sample hotels that I have tried to book in the past that came in at or under 85,000 points for selected dates:

- The Ritz-Carlton Maui, Hawaii

- JW Marriott Maldives Resort & Spa

- Prince de Galles, a Luxury Collection Hotel, Paris

- The St. Regis Deer Valley

- The Ritz-Carlton Georgetown, Washington, DC

- The Ritz-Carlton Bachelor Gulch, Colorado.

- The Ritz-Carlton, Koh Samui (Thailand)

- The Mauna Kea Beach Hotel (Big Island, Hawaii)

- The St. Regis Maldives Vommuli Resort

- Wailea Beach Resort – Marriott, Maui

NEW: Certificates can be combined with up to 15,000 points for nicer hotels. Marriott now allows you to supplement your free night certificates with up to 15,000 points of your own. In other words, if your certificate is worth 85,000 points, the maximum hotel value you can redeem for is 100,000 points after adding 15,000 points of your own. Here are details on the Free Night Award Top Off option.

Bonvoy Points can also be transferred to airline miles with a bonus. You can convert your Bonvoy points to miles at 39 participating airlines. The standard ratio with most programs is 3:1 (60,000 Bonvoy: 20,000 airlines) miles. Most programs will add on a bonus 5,000 miles for every 60,000 points you transfer to frequent flyer miles (does not apply to American Airlines AAdvantage, Avianca LifeMiles, Delta SkyMiles and Korean Air SKYPASS.) If you’re a United MileagePlus® member, you’ll get 10,000 bonus miles for every 60,000 points you transfer. More information here.

Finally, Marriott points are also convertible to gift cards, but it takes 60,000 points to redeem for a $200 gift card for Marriott or retailers like Best Buy, Home Depot, or Nordstrom. That ratio isn’t all that great, so you’ll definitely get the most value via hotel night redemptions or airline miles transfer.

Bottom line. The card_name is the premium co-branded card between Marriott hotels and American Express. There is a long list of perks, including a flexible dining credit on restaurant purchases and a valuable free night award each card anniversary. As with all hotel cards, the value is dependent on your unique travel preferences.

Also see: Top 10 Best Credit Card Bonus Offers.

Updated September 2025. Do you have small business income or work as an independent contractor? Freelance, Uber/Lyft, DoorDash, Amazon, eBay, Etsy, Airbnb? A small business credit card separates your personal and business expenses and can build up your business credit profile. If you are not a corporation or LLC, you can apply as a sole proprietorship, with your name as the business name and your Social Security number as the Tax ID number. These are the top 10 credit card offers that I would personally apply for right now (or have already). Recent changes:

Updated September 2025. Do you have small business income or work as an independent contractor? Freelance, Uber/Lyft, DoorDash, Amazon, eBay, Etsy, Airbnb? A small business credit card separates your personal and business expenses and can build up your business credit profile. If you are not a corporation or LLC, you can apply as a sole proprietorship, with your name as the business name and your Social Security number as the Tax ID number. These are the top 10 credit card offers that I would personally apply for right now (or have already). Recent changes:

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)