Joe Davis and Andy Clarke of The Vanguard Blog had a thought-provoking post comparing the increasing popularity of broadly-diversified, low-cost portfolios to the historical spread of certain technologies:

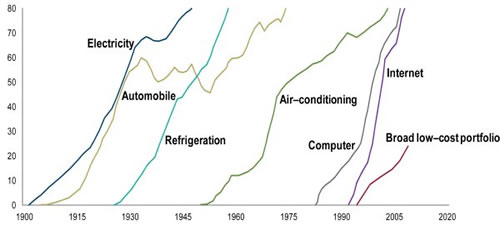

Much like electricity, refrigeration, and other great ideas, the broadly diversified, low-cost portfolio has the potential to raise our standard of living. […] The adoption of great ideas typically follows an “S” curve, starting slowly, then accelerating. Eventually, the great idea becomes commonplace. The adoption of the “broad low-cost portfolio” seems to be following this pattern.

Here’s a chart they created illustrating how the adoption of various technologies spread to include the majority of US households.

Defined as the percentage of U.S. mutual fund and ETF assets under management with annual expense ratios of less than 25 basis points (0.25%), low-cost investing has grown from less than 5% penetration in 1995 to about 25% of industry assets in 2012. Very few ETFs or mutual funds charge such low amounts unless they passively track an index, so at least right now low-cost is nearly synonymous with index funds. Will low-cost investing one day be as common as owning a car?

Tadas Viskanta adds more commentary in this Abnormal Returns post. It does seem like index fund investing has been gaining some momentum lately, partially because most hedge funds have been lagging major indexes for some time.

(See also:

(See also:

Over the years, I’ve noticed that people tend to overestimate their own stock-picking prowess – myself included. Especially over longer periods of time, if you’re not tracking things carefully you probably don’t know how well you’re doing on a relative basis. We all tend to remember the winners and forget the losers. The sooner you figure out you’re not Buffett, the sooner you can improve your returns. (Otherwise, the sooner you can start your own hedge fund.)

Over the years, I’ve noticed that people tend to overestimate their own stock-picking prowess – myself included. Especially over longer periods of time, if you’re not tracking things carefully you probably don’t know how well you’re doing on a relative basis. We all tend to remember the winners and forget the losers. The sooner you figure out you’re not Buffett, the sooner you can improve your returns. (Otherwise, the sooner you can start your own hedge fund.)

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)